Yuexiu Property successfully signed a HK$1.56 billion sustainability-linked loan (SLL) with a maturity term of three years on 12 June 2025. This is the first SLL signed by Yuexiu Property and represents another breakthrough in the field of sustainable finance, following the Company’s establishment of a sustainable finance framework and issuance of green bonds in 2024. This fully demonstrates Yuexiu Property's commitment to promoting sustainable development through sustainable finance.

SLLs are an emerging green financial instrument launched, issued and guided by international market self-regulatory organisations. Unlike traditional loans, which rely solely on corporate credit ratings pricing, SLLs are closely tied to corporate social value creation, incentivising enterprises to achieve pre-set sustainability performance targets (SPTs) with innovative loan terms. SLLs aim to promote and support the growth of business activities that contribute to environmental and social sustainable development by linking loan costs to borrowers' sustainability performance targets in the areas of environment, society, and corporate governance, thereby leveraging incentives to foster the long-term healthy development of the economy and society. The successful signing of Yuexiu Property's first SLL has further enriched the Company's sustainable finance portfolio and broadened its financing channels.

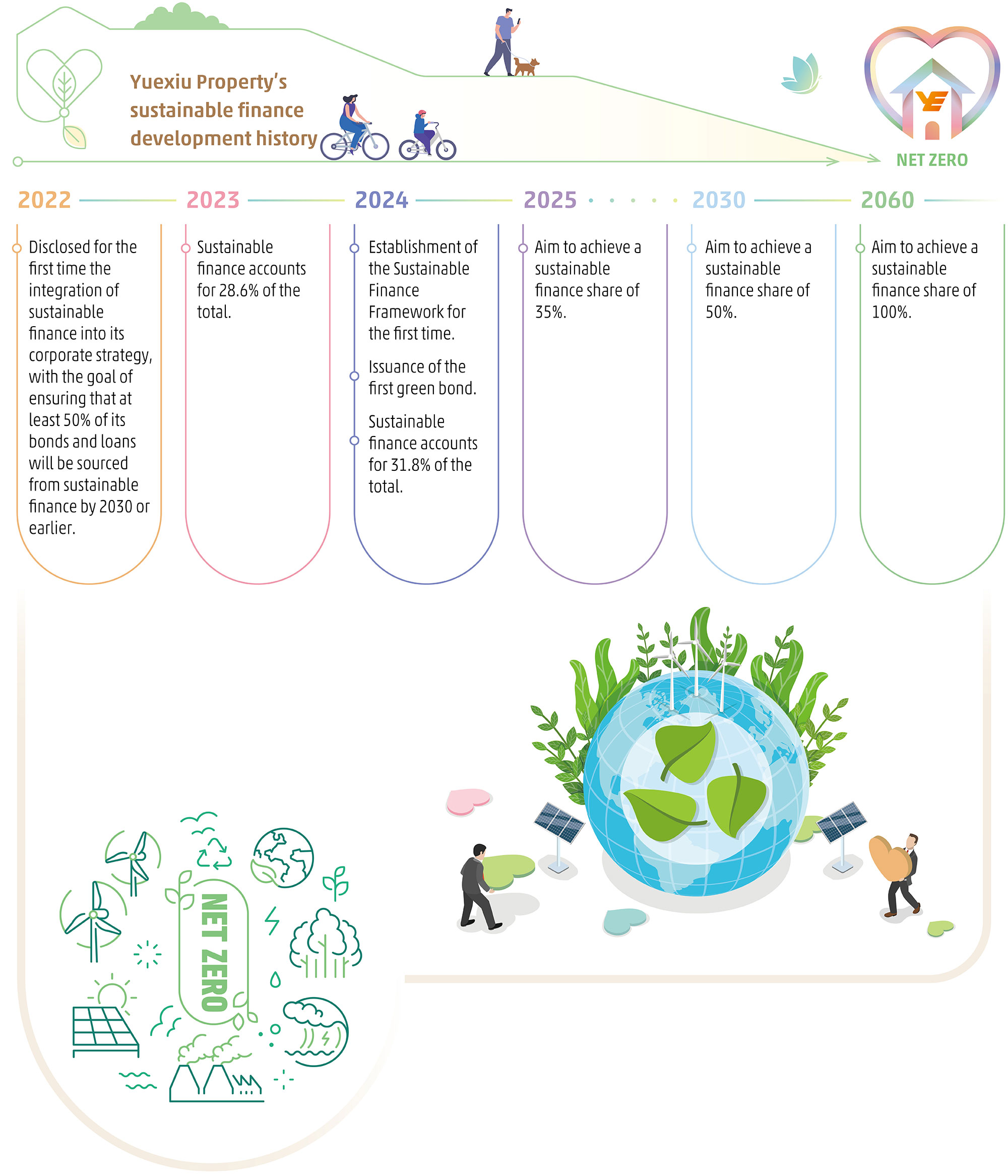

In 2022, Yuexiu Property disclosed for the first time that it had incorporated sustainable finance into its corporate strategy and outlined its vision for sustainable finance development: to achieve 100 % sustainable finance by 2060 or earlier.

Under the guidance of the Sustainable Finance Framework, sustainable development principles have been comprehensively integrated into the Company’s financing strategy, and various sustainable financing tools, including green bonds, green loans and loans linked to sustainable development performance, are being explored. The funds raised through sustainable financing transactions will be used for Yuexiu Property's eligible green projects, and the concept of environmental protection will be deeply interwoven with business development, providing impetus to the Company's future development. In 2024, the proportion of bonds and loans sourced from sustainable financing reached 31.8%.

Looking ahead, Yuexiu Property will continue to adhere to a sustainable development model that emphasises both quality and efficiency, actively respond to climate change, reduce greenhouse gas emissions and promote the use of sustainable finance. By leveraging sustainable financing as a powerful tool, Yuexiu Property will further enhance its financial flexibility and risk resilience, and advance the transition towards a green and low-carbon economy, ultimately making it an indispensable part of Yuexiu Property's carbon reduction master plan.